We provide custom application development services that transform how financial and insurance companies interact with their clients. Our solutions use the latest technology to create user-friendly apps, offering personalized financial planning tools, secure transactions, and a seamless experience. With advanced analytics, we help you make better decisions, improve efficiency, and cut costs. We also ensure full compliance with regulations and prioritize data security.

Manage financial portfolios, investments, and assets with real-time tracking and insights.

Monitor risk factors and perform in-depth analytics to drive informed financial decisions.

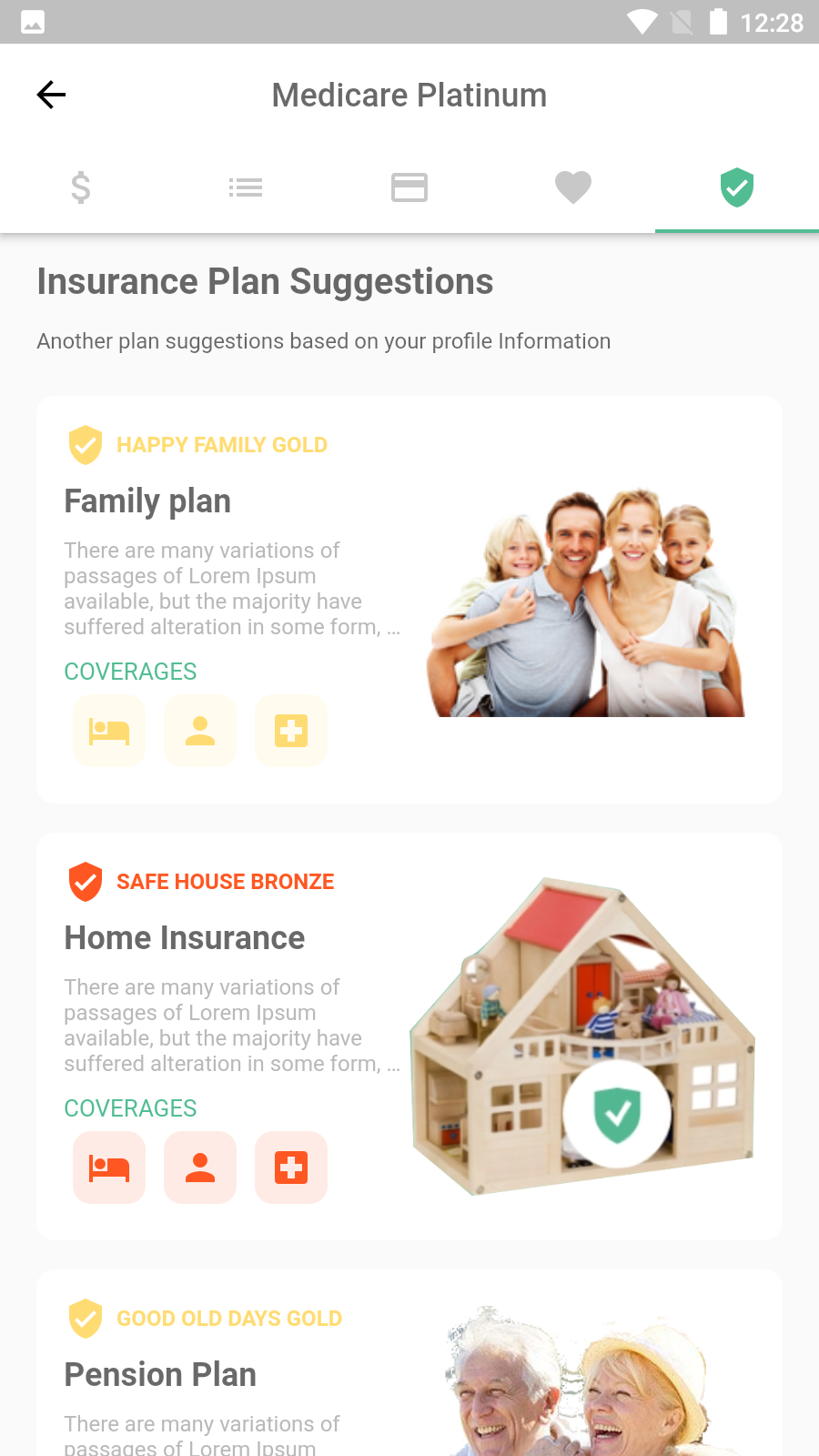

Access financial data and insurance information on the go with a mobile-friendly platform.

Offer direct communication channels for clients to address queries, report claims, and get assistance.

Streamline insurance claims with a fully integrated system for easy submission, tracking, and approval.

Allow clients to manage their policies, renewals, and updates efficiently, with automatic reminders.

Ensure the highest level of security for all financial transactions with encrypted data and compliance standards.

Enable global access to financial tools and services, fostering cross-border investment and insurance opportunities.

Explore the dynamic functionality of our finance and insurance application, designed to provide seamless services for customers, agents, and administrators.

Transform the way you manage financial transactions, analyze data, and improve customer interactions with our advanced features tailored for the finance and insurance industry.

Leverage real-time analytics to gain insights into financial performance, trends, and customer behavior to make informed decisions.

Efficiently manage client profiles, insurance policies, claims, and communication to deliver a personalized experience and boost satisfaction.

Streamline policy renewals and reminders with automated notifications to keep clients informed and maintain seamless service.

Keep clients updated with real-time notifications on their claims status, policy changes, and any important financial updates.

Utilize advanced tools to assess and manage risk, offering proactive solutions for clients while ensuring financial security.

Facilitate secure communication between clients and agents, ensuring privacy and compliance with industry standards through encrypted messaging.